As modern retail increasingly integrates mobile into a seamless omni-channel experience, the need for quick and secure transactions across all channels has become paramount. As a result, innovative payment solutions that prioritize convenience, speed, and safety are increasingly in demand.

Mobile POS systems are becoming more important and pervasive, necessitating connected devices that can be pooled across multiple mobile platforms. Shared printers and PED devices connected to mobile POS registers significantly reduce hardware and maintenance costs.

Additionally, as consumers embrace quick payment options like digital wallets and tap-to-pay cards, retailers must adapt their commerce solutions to accept these methods, reducing transaction turnaround time and meeting growing customer expectations.

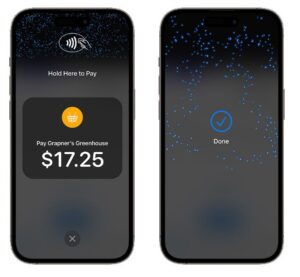

Tap to Pay on iPhone

Tap to Pay on iPhone is a contactless payment acceptance method that allows merchants to accept in-person payments directly from customers’ compatible physical or digital payment cards. Customers can use their contactless cards or NFC-supported smartphones to tap on a contactless-enabled iPhone, eliminating the need to swipe or insert payment cards. This solution benefits both merchants and customers due to its convenience and enhanced security features, leading to its widespread adoption by businesses.

Tap to Pay on iPhone can accept various payment methods, including physical Credit/Debit Cards and Digital Wallets such as Apple Pay, Google Pay, Samsung Pay, and PayPal. This ensures simplicity, security, and privacy for users. These attributes, combined with the rising trend of contactless payments, intuitive user experience, effective marketing and promotions, collectively contribute to the growing adoption of Tap to Pay on iPhone. Additonally, merchants can use Tap to Pay on iPhone for issuing refunds, accepting loyalty cards, and validating credit cards.

Understanding Tap to Pay on iPhone

Tap to Pay on iPhone utilizes Near Field Communication (NFC) protocols, enabling secure wireless data transfer over short distances via radio waves. This robust technology ensures that payment card information is securely transmitted to the iPhone’s card reader component via its chip or antenna, making it a secure payment device.

When a payment card, such as a credit/debit card or a smartphone equipped with digital wallets, is held near an iPhone XS or later to make a transaction, the encrypted card data is transferred to the iPhone’s card reader component. Subsequently, the iPhone’s card reader component transmits the card data to the payment library provided by the PSP (Payment Service Provider). The payment library verifies the card information and forwards the details to the PSP for further processing. Finally, the transaction is authorized through the bank or card issuer. This process ensures quick, convenient, and secure transactions.

Tap to Pay on iPhone, when integrated with a Point-of-Sale (POS) application, functions similarly to other PED (Pin Entry Device) terminals, but with more convenience and faster transactions. It supports payments/tendering for all types of sales and returns, voids and post-voids. The design is modular ensuring that other POS integration and functionalities are not affected.

Security of Transactions

Security in financial transactions is paramount, and Apple handles it seamlessly. Tap to Pay on iPhone transactions are safeguarded by a multi-layered security approach that incorporates tokenization and biometric authentication (Touch ID or Face ID). Transactions cannot proceed without authentication, ensuring that sensitive payment information is always protected, thus reducing the risk of fraud or theft.

Need help with your MPOS implementation?

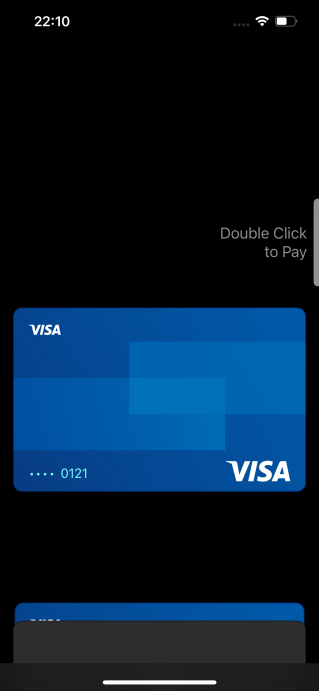

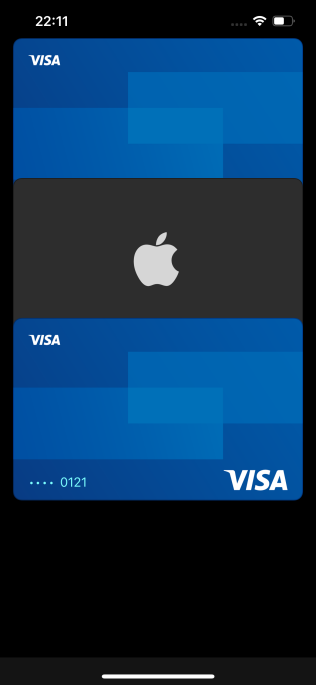

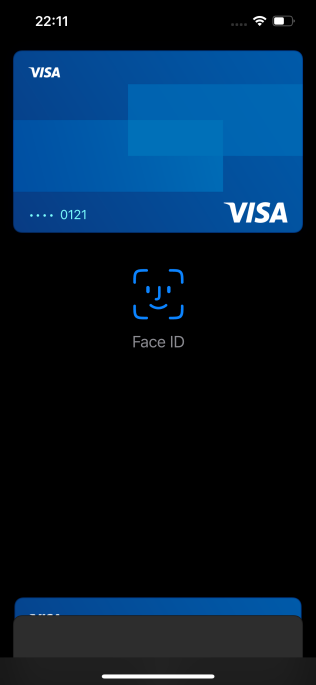

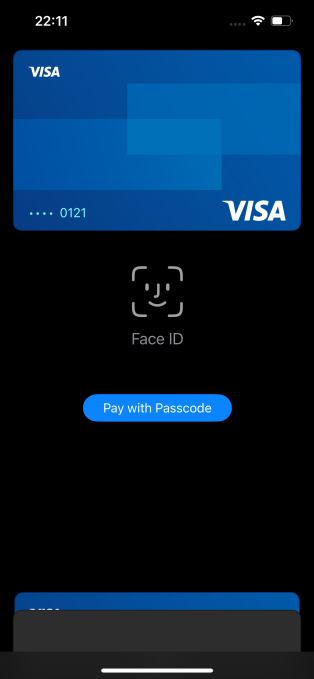

Customers using an iPhone or Apple Watch benefit from the same security measures. They need to configure their card in the Wallet app, part of Apple Pay. When using Apple Pay, the device prompts the saved cards, allowing selection of a different card if desired. Confirmation is completed by double-clicking the side button, followed by Face ID or passcode authentication. This ensures secure transactions for both customers and merchants.

Fig: Presenting saved cards with Face ID and passcode on iPhone

SkillNet’s Innovative Integration Solution for Tap to Pay on iPhone

SkillNet offers a seamless payment solution integrating Oracle Retail Mobile POS Solution (Xstore Mobile) with Payment Mobile SDKs (e.g. Adyen) enabling Tap to Pay on iPhone. This integration eliminates the need of external PEDs (Pin Entry Device), allowing customers to tap their card on the iPhone with the Xstore Mobile app or use a stored card on their NFC-enabled smartphone for swift transactions.

Tap to Pay not only enhances consumer experience but also boosts transaction throughput for merchants. This innovative approach to mobile Tap to Pay sets a new standard for modern retail payment solutions, positioning all stakeholders for long-term success in an evolving market landscape.

Skillnet has added business value for one of the luxury retailers in Europe by implementing the Tap to Pay journeys in addition to their existing payment methods. Using the device in-built capabilities of NFC Data Capture and data encryptions, and building a connector between iPhone Data Reader Component and Payment provider SDK, mobile use-cases are extended to support this additional payment type.

This has given the benefits of leveraging their current payment architecture for quick turnaround of customer transactions.The sales, return, void flows are supported with Adyen SDK and Apple iOS Tap to Pay enabler. The standardized design facilitates implementation in other regions with different payment providers, provided Tap to Pay is supported. Customers can now use multiple wallets and cards without requiring the retailer to add more physical devices or engage in device pooling.

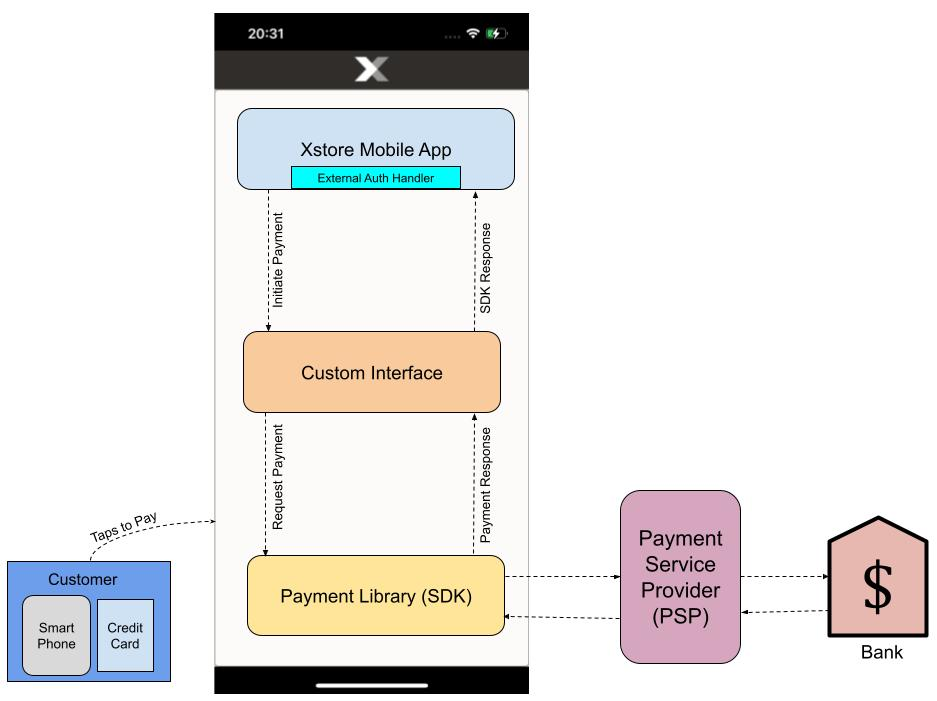

Solution Architecture

The Tap to Pay on iPhone solution features a straight-forward architecture. A custom mobile POS app component is integrated within the Xstore Mobile App, enabling seamless request-response communication between the payment service provider and the Xstore Mobile server.

Transaction Process Flow

1. The merchant initiates the Tap to Pay payment request on the Xstore Mobile app.

2. The request is transmitted to the Software Development Kit (SDK) provided by the Payment Service Provider (PSP).

3. The SDK authorizes the request by communicating with the PSP server.

4. The request is then forwarded to the Tap to Pay component of the iPhone, which reads the card details using the iPhone’s native interface.

5. When the customer taps their payment device, the chip and antenna securely transmit payment details to the contactless reader integrated within or connected to the point-of-sale (POS) system.

6. For added security, Tap to Pay on iPhone may prompt customers to enter their PIN using Apple’s secure PIN entry interface.

7. With payment confirmation typically instantaneous for lower-value purchases, a smooth and efficient checkout experience is ensured.

Transaction Processing and Integration

The transaction request is interfaced to PSP server and then SDK forwards the payment response to the Xstore Mobile server. The Xstore Mobile server processes the payment and adds the tender to the transaction. With Xstore Mobile, Tap to Pay on iPhone seamlessly integrates with the other PED pooling options, supporting customers without tap-to-pay cards or payment-enabled devices. Additionally, deployment is simplified using the same Mobile POS IPA file distribution via Mobile Device Management (MDM).

Need help with your Payment System implementation?

Implementing Tap to Pay on iPhone

To adopt Tap to Pay on iPhone, merchants must collaborate with a Payment Service Provider (PSP) that supports this functionality. Key steps for seamless integration include:

1. Requesting the Tap to Pay on iPhone Entitlement from Apple.

2. Integrating the Proximity Reader API.

3. Adhering to Human Interface Guidelines.

Currently, this solution has some dependencies and limitations, such as only working on iPhone and not iPad. This limitation is primarily due to the lower demand for contactless payments on iPad compared to iPhones, given their different usage patterns.

Conclusion

Tap to Pay on iPhone revolutionizes the shopping experience, offering seamless transactions and eliminating the hassle of physical cards and waiting in lines. For businesses, it enhances customer satisfaction, sets them apart from competitors, and fosters long-term brand loyalty. Merchants benefit from accelerated checkouts, reduced cash handling, and increased profits, while also gaining the flexibility to accept payments anywhere. Moreover, Tap to Pay ensures secure transactions, simplifies processes, and seamlessly integrates with other payment options, making it a cost-effective and efficient solution for businesses and customers.

This blog is written by Kumar Sharma and Saurabh Pant.

Learn more about our POS Payment Solutions.

Read our blog on Key considerations when extending your Oracle POS with Xstore Mobile POS.

Click to read our blog on Examining MPOS Technology Adoption in Retail with a Spotlight on Oracle Xstore Mobile.